Arbitrum Protocol Surpasses ETH In Daily Activity For Second Time

The Arbitrum protocol recently hit over 200 million transactions. Experts claim the protocol’s mainnet, Arbitrum One’s performance is the reason behind it. What can the market anticipate when it comes to Arbitrum’s token airdrop?

Initially, Arbitrum garnered significant interest when it announced the release of its long-awaited token airdrop. The protocol even surpassed Ethereum in terms of daily active addresses due to the excitement surrounding the event. However, as time went on, the buzz surrounding the Arbitrum network began to dwindle.

Subsequently, the decline in hype around Arbitrum resulted in a decrease in network activity and transaction volume. Additionally, the brief period during which Arbitrum surpassed Ethereum in terms of daily activity was dismissed as a singular occurrence.

However, Arbitrum has once again surpassed Ethereum in terms of daily activity. This recent development suggests that the heightened level of activity on the Arbitrum network might be a pattern rather than a one-time occurrence.

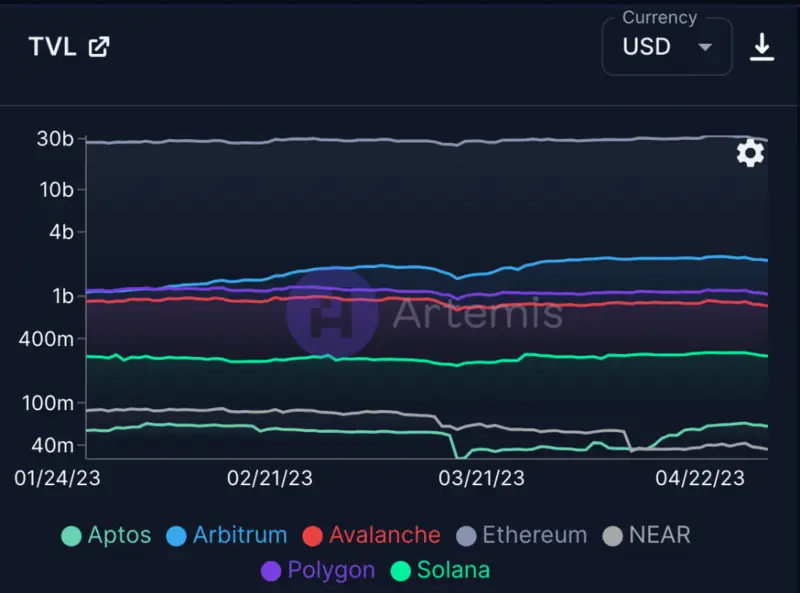

The extensive adoption of the Arbitrum protocol has corresponded to a significant rise in the total value locked (TVL) in its smart contracts. According to Artemis’ data, except for Ethereum, the Arbitrum protocol has outperformed most other projects in this regard, with its TVL reported to be $2.2 billion at present.

Although Arbitrum’s protocol experienced high activity, the same cannot be said for its GitHub. Token Terminal’s data showed a significant decline in the number of active developers on the network over the past few months. Moreover, the number of code commits to Arbitrum’s GitHub has dropped by 51.4% in the last 90 days.

If this trend continues, it could take Arbitrum longer than other protocols to introduce new Features and upgrades, potentially leading to a loss of its dominant position in the market.

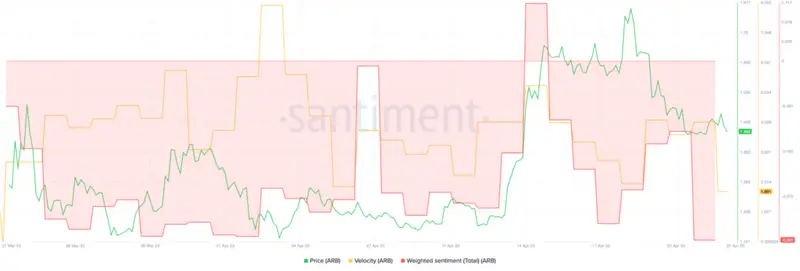

Despite the positive performance of the protocol, the overall sentiment around ARB has been negative. Santiment’s data indicated a sharp decline in weighted sentiment over the last few days, accompanied by a drop in the velocity of the ARB token. This decline in sentiment and trading frequency caused the price of ARB to plummet on the charts.

Comments

Post a Comment