Opportunity? Will the ‘Banana Zone’ ignite a major altcoin bull run?

Bitcoin’s (BTC) recent surge to a record $73,750, followed by a pullback to $61,000, has set the stage for what many in the cryptocurrency sector believe could be the onset of an altcoin season. This anticipated phase is expected to boost altcoins to new heights, outpacing Bitcoin with significant gains.

With meme coins and AI-themed cryptocurrencies outperforming Bitcoin recently, industry experts are debating whether the altcoin rally has already begun.

Raoul Pal, a renowned macro guru and CEO of Real Vision, in his recent podcast has sparked discussions about a possible major uptrend in the altcoin market, referred to as the ‘Banana Zone.’

Picks for you

Pal emphasizes Ethereum’s (ETH) potential trajectory and Solana’s (SOL) promising position due to its nascent stage in the adoption curve.

It’s very normal for crypto spring for Bitcoin to outperform and then as we come into crypto summer that we’re transitioning into now, ETH starts to outperform Bitcoin. This is a terribly unpopular thing to say because people say well ETH is dead, it’s a dead chain, it’s not working, blah blah blah, just wait, have patience, you will see. Will it outperform Solana? I very much doubt it. Solana’s earlier in the adoption curve so it means the percentage changes are larger

Raoul Pal

Analyzing the market cycles

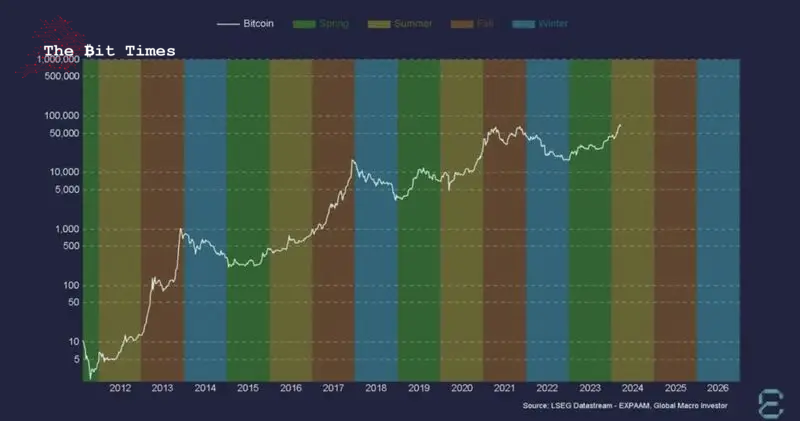

Notably, Pal highlights the cyclical pattern observed in cryptocurrency markets, noting that Bitcoin often leads in performance during ‘crypto spring.’ As the market shifts into ‘crypto summer’, Ethereum is expected to outshine Bitcoin.

This trend, according to Pal, is based on past market behaviors which show Ethereum gaining momentum as it enters phases of increased activity and valuation surges.

In particular, he highlighted the years 2013 and 2017 as benchmarks for typical growth patterns. He contrasts these with a recent cycle that exhibited a “stunted” growth and a “double-toppy” pattern, which was unusual.

Therefore, by referencing these previous cycles, Pal assesses and predicts the behavior of current and future market cycles, using the robust growth and subsequent corrections of 2013 and 2017 to guide expectations and strategic planning in the cryptocurrency space.

The advent of the ‘Banana Zone’

The ‘Banana Zone’ represents an anticipated period of extreme market activity expected to begin when altcoins break past previous all-time high market caps. Pal forecasts this critical juncture could occur as early as 2024, with total market capitalization potentially soaring to between $10 trillion and $12 trillion.

This would mark a dramatic increase from the current market cap of approximately $2.7 trillion, underscoring a bullish scenario for altcoins.

The sentiment around a looming bull run is echoed by other cryptocurrency experts.

Analysts like Michaël van de Poppe highlighted altcoins such as Optimism (OP), Chainlink (LINK), Celestia (TIA), Woo (WOO), and Skale (SKL), noting their potential to triple in value against Bitcoin with minimal risk.

Similarly Lark Davis, another prominent figure in the crypto space, describes the recent price dip as an unparalleled buying opportunity for investors ready to capitalize on the next bull run.

As the crypto market gears up for what may be an unprecedented period of growth, Pal’s insights and the supportive views from other experts suggest that the ‘Banana Zone’ could indeed be the trigger for the next major altcoin rally.

Investors are advised to remain informed and strategic, leveraging these insights to navigate what promises to be a dynamic and potentially rewarding market phase.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment