‘Rich Dad’ Robert Kiyosaki explains his big bet on Bitcoin

The prominent investor and popular author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has been known to favor a set of assets over most other investments.

Though three – gold, silver, and Bitcoin (BTC) – are generally the most mentioned, Kiyosaki is likewise generally engaged with Solana (SOL), wagyu cattle, and real estate.

In an X post made late on October 30, the author took the time to offer a simple explanation as to why he likes – or, as he put it, loves – one of them: the world’s premier cryptocurrency, Bitcoin.

Picks for you

Why Robert Kiyosaki loves BTC

He positioned the explanation as a simple dichotomy – owning BTC makes him richer while keeping his wealth in a more traditional currency, like the dollar, makes him poorer.

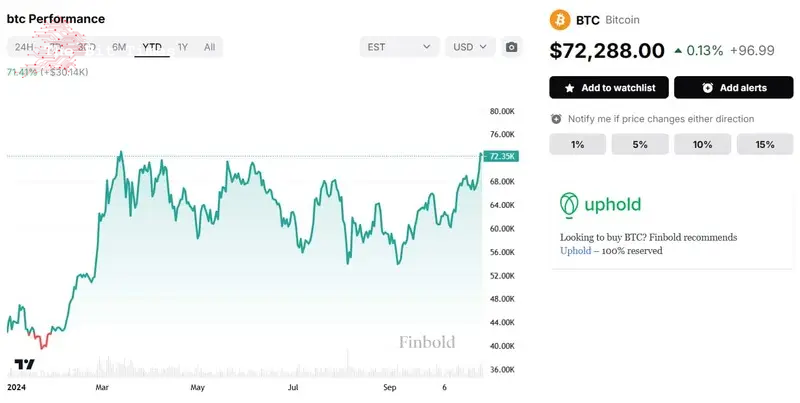

As it turns out, the simplicity of the explanation is rather fitting. A $1,000 investment made in Bitcoin exactly five years ago, on October 31, 2019, would now be worth $7,865 – almost a $7,000 profit.

According to the data retrieved from the Bureau of Labor Statistics’ inflation calculator, stashing $1,000 in American currency in a piggy bank at the same time would have depreciated in value.

Specifically, to match the purchasing power of $1,000 in 2019, one would need to have $1,225.20.

Why Kiyosaki’s explanation is problematic but valid

Still, the simplicity of the answer might also be somewhat duplicitous. For example, the same Bitcoin investment measured two years ago would have appreciated but by a significantly lower $1,000.

On the other hand, a $1,000 BTC investment made in March of 2024 would have lost some of its value by October 31. On March 13, Bitcoin hit an all-time high (ATH) just shy of $73,100 but at press time, it is trading at $72,288.

The temporality of the situation, however, does not truly undermine Kiyosaki’s reasoning, though it has to be said that it is more of an argument in favor of investing as such and not specific to Bitcoin.

For example, if timed exactly the same five years ago, an S&P 500 investment made in 2019 would have grown from $1,000 to almost $2,000 – admittedly less than one made in BTC.

On the flip side, if a trader opted for another asset, perhaps the stock of the semiconductor giant Nvidia (NASDAQ: NVDA), their $1,000 would have risen to over $27,000 by October 31, 2024 – significantly more than Bitcoin.

Does comparing BTC and USD even make sense?

What could be called into question is the juxtaposition of Bitcoin against traditional currencies such as the American dollar.

It is true that BTC was originally intended as an alternative to fiat, a way for people to have confidence that Central – or other major – banks’ machinations won’t erode their wealth – a pointed concern in the aftermath of the Great Recession – but this plan is still aspirational in 2024.

Indeed, despite being accepted at numerous locations as a method of payment, Bitcoin remains, first and foremost, a risk asset and an investment.

It is also arguably unfair to compare an asset whose primary function is to be exchanged for goods, services, and other assets and which is designed to be mostly stable with a highly volatile cryptocurrency.

Despite its devaluation, $1,000 in 2019 dollars had the same purchasing power as $1,011.82 on October 31, 2020, $1,074.77 on the same date in 2021, and $1,158.02 in 2022 – and this is despite the U.S. and the world experiencing generationally high inflation in the aftermath of the COVID-19 pandemic.

The price of Bitcoin on October 31, 2019, was $9,199.59, $13,781 in 2020, $61,443.95 in 2021, and $34,667.78 on the final day of the same month in 2022 – meaning that the McDonald’s (NYSE: MCD) dollar menu, if denominated in BTC but not regularly adjusted for such ‘hyperinflation’ could set you back anywhere between $1 and $7 depending on the year.

Comments

Post a Comment